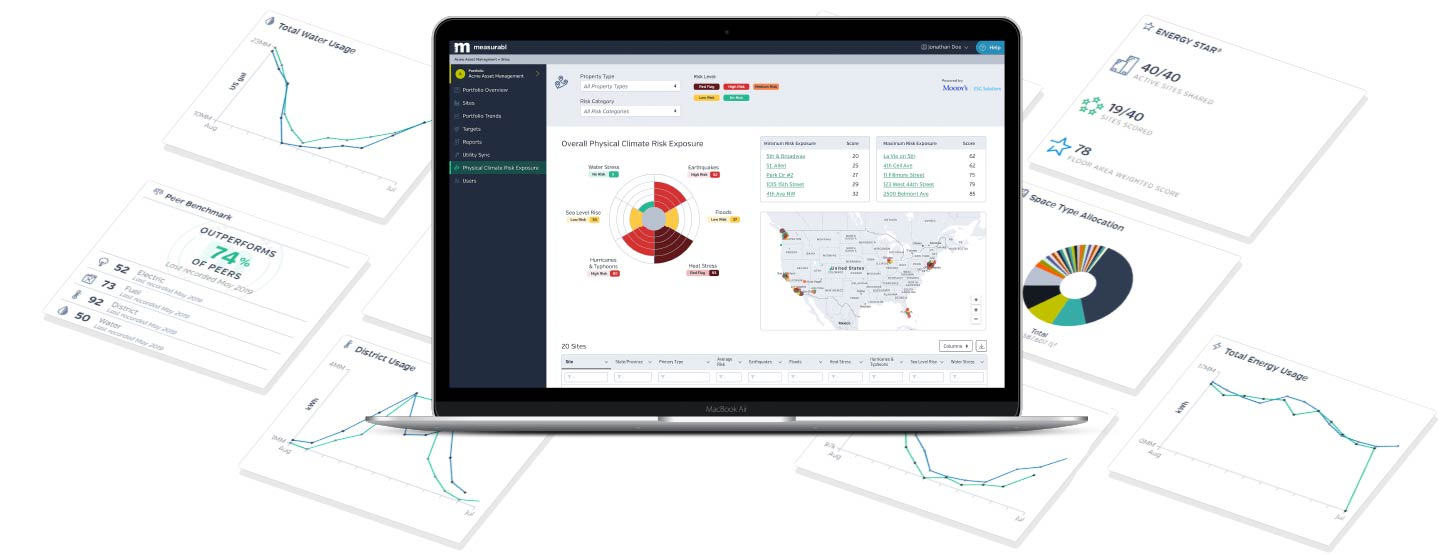

Meet the ESG platform built for real estate

Learn why industry leaders use Measurabl to measure, manage, disclose, and act on ESG data

ESG (environmental, social, governance) data has gone from “nice to have” to a leading performance indicator for commercial real estate. ESG standards held by investors and regulators continue to evolve. As a real estate owner, you need to provide more accurate, granular data on demand. You also need a scalable solution that can grow with your portfolio.

modern and scalable solution

Say goodbye to spreadsheets

Capturing ESG data creates value across your organization—from company operations to financing activities. By acting on this data, you will improve your scores across multiple sustainability frameworks, increase brand resonance and enhance enterprise value.

measure

Automate the collection of meter-level electricity, water, fuel, district and waste data from thousands of utilities. Track progress toward sustainability targets and compare your performance with custom peer groups.

manage

Maintain social and governance documents alongside your environmental data. Ensure your green building certifications are always up-to-date.

disclose

Streamline the arduous annual reporting process to frameworks such as GRESB and CDP. You can also customize your own ESG reports on demand.

act

Leverage accurate, asset-level ESG data so you can implement physical climate risk strategies, improve operational efficiencies, and gain better access to capital.

all-in-one sustainability hub

Manage and report ESG in one place

Connect your people and locations globally to a single source of ESG truth. From there, manage targets and disclose results to global ESG frameworks such as GRESB, CDP and more.